In comparison, revenue for BABA's cloud business segment grew by a much faster +33% YoY in Q2 FY 2022. Secondly, Alibaba's cloud business segment only registered a "relatively modest" +20% YoY revenue growth in the third quarter of fiscal 2022. Alibaba acknowledged at its recent quarterly earnings call that no one can be certain whether there will be a "V-shaped or a U-shaped recovery" for consumer demand in the country. The near-term outlook for Alibaba's China commerce business remains murky. These were the same reasons for the moderation in Alibaba's customer revenue growth on a YoY basis in Q2 FY 2022. In other words, the financial performance of Alibaba's core China commerce business has gotten worse in recent quarters.īABA explained at its Q3 FY 2022 investor briefing on Februthat "slowing market conditions and competition in the China e-commerce market" and "increased merchant support" were responsible for the decrease in its China commerce business' customer management revenue. I mentioned in my prior Decemupdate that "Alibaba's customer management revenue growth slowed considerably from +14% YoY in Q1 FY 2022 to +3% YoY" for Q2 FY 2022. There are three key financial and operating metrics that were disclosed as part of Alibaba's most recent quarterly earnings which warrant more attention.įirstly, BABA's customer management revenue for the company's core China commerce business declined by -1% YoY to RMB100.1 billion, as indicated in the company's Q3 FY 2022 earnings presentation.

BABA Stock Key Metricsīefore I highlight where Alibaba will be and what its shares will be worth in 2025, I do a review of BABA's Q3 FY 2022 (YE March 31) financial results focusing on specific metrics. My valuation for Alibaba suggests a +9.4% three-year investment return CAGR for its shares, which warrants a Hold investment rating for the stock. The more moderate top line growth expectations imply that the stock deserves a lower P/E multiple. Key factors that investors should consider in assessing BABA's outlook include ARPU growth for the China commerce business and the diversification efforts for its cloud business. In 2025, Alibaba should be a company boasting slower revenue growth albeit with stable profitability. I focus on Alibaba's intermediate-term outlook in this latest update.

ALIBABA STOCK FORECAST NEXT 12 MONTHS UPDATE

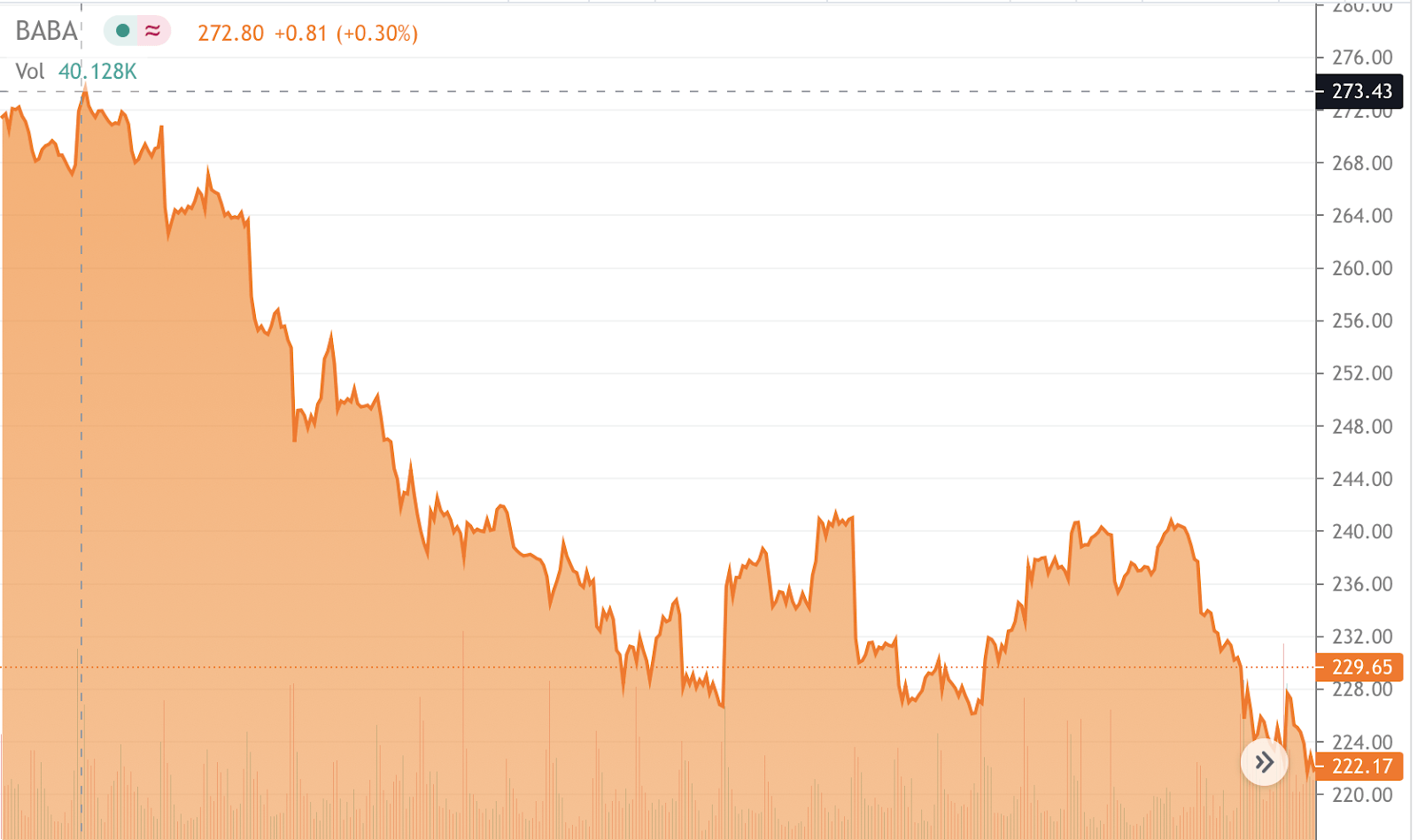

In my previous article published on December 3, 2021, I noted that "I am not optimistic that BABA's shares can stage a strong rebound in the near term" and I turned out to be right thus far with Alibaba's shares down by -5.8% in the past three months.Īlibaba's Stock Price Performance Following My Earlier Update I retain my Hold rating for Alibaba Group Holding Limited ( NYSE: BABA). Andrew Burton/Getty Images News Elevator Pitch

0 kommentar(er)

0 kommentar(er)